Table of Content

For example, let’s say that you purchase your home for $150,000 and now it’s worth $300,000. You have $150,000 in equity, which is far greater than the $30,000 (or 20%) amount of the loan amount. Asking to drop the PMI can save you a sizable amount of money each month and help lower the monthly payment. Second mortgage with no interest, no payments and loan forgiveness.

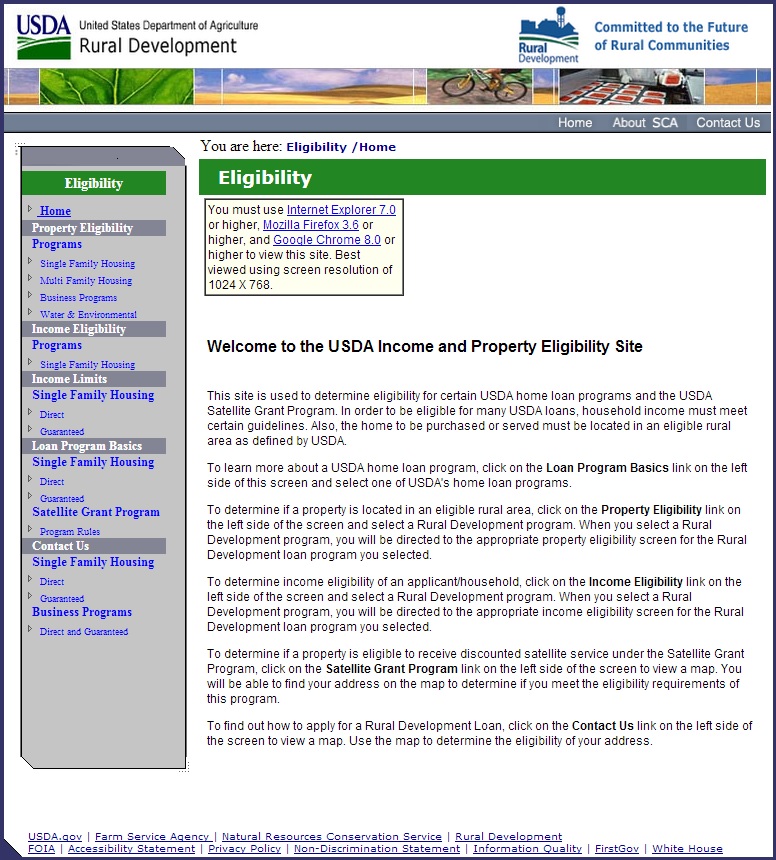

Private mortgage insurance is usually required to pay per month if you put down less than 20% of your home’s purchase price. Arizona Down Payment Assistance offers down payment, closing cost, and support to first time home buyers in the Arizona area. These programs aim to eliminate the barrier to entry for homeownership, and in some cases, can be used in conjunction with first time home buyer programs. The program also has a maximum loan-to-value amount, which varies from 96.50% to 97%.

FHA loans

That means you can’t use these loans for a vacation home or investment property. Quicken Loans offers several mortgage products, including FHA loans. You’ll benefit from the customer service and intuitive website to help you navigate the mortgage process. Rocket Mortgage® also offers preapproval where you could receive a decision on the same day.

Down payment assistance allows you to make a down payment with little to no out-of-pocket expenses. In most situations, you need a FICO® credit score of at least 620 to secure a VA loan. You also need to pay a VA fund fee, which ranges anywhere from 1.25% to 2.4% of your home’s value depending on the size of your down payment . The Arizona Industrial Development Authority’s HOME Plus program is the only state-run, statewide, home buyer down payment assistance program in Arizona.

Arizona first-time home buyer programs

Borrowers using this program can make a down payment as low as 3.5% on the home. Additionally, credit scores as low as 580 are considered for FHA mortgage loans. The type of loan also allows for “down payment gifts,” which means that someone can “gift” you the entire down payment amount.

This mortgage is set up as a second mortgage, but you don’t need to make payments on the loan. The amount is fully forgiven after the 36th month of homeownership. However, if you decide to sell or refinance the mortgage before the 36th month, you will need to pay that second mortgage in full. Borrowers on the mortgage must have a credit score of at least 640.

Arizona First Time Home Buyer Programs

The 48th state is a popular location for homebuyers, and with homeownership assistance programs, buying a home here is becoming a reality for even more people. Has an excellent beginning guide to homeownership and tracks indicators and trends for the housing mortgage finance industry. For example, if you have a credit score of 580, you may have difficulty qualifying for the Arizona IDA program. If you’re a retired military vet, you may qualify for a VA loan with no down payment requirement and lenient qualifying criteria.

Credit score of 580 or above Best For – Anyone without enough savings to cover a typical down payment FHA loans are backed by the U.S. These loans are a great option for anyone that doesn’t have the upfront funds usually needed to purchase a home. While conventional loans require a 20% down payment, you’ll only need to put down 3.5% of your home’s value. You must have a credit score of at least 580 on the FICO® scale to get that 3.5% down payment, though. If your score falls anywhere between 500 and 580, you’ll need to make a down payment closer to 10%. See if any of the programs can offer you a grant to cover your down payment and closing costs.

Arizona home buyer stats

If you’ve longed to call Mesa home, the Homeownership Assistance Program is here to help. Eligible homebuyers can receive funds to assist in the down payment and closing cost expenses toward a new home. The program is targeted toward low- and medium-income families.

If you are a WordPress user with administrative privileges on this site, please enter your email address in the box below and click "Send". Imagine buying the home you wanted without the money you thought you needed. Department of Housing website provides details on how the Pathway to Purchase Down Payment Assistance program works, including a breakdown of which ZIP codes and cities are targeted. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

As a highly reputable first-time buyers lender in Arizona, KHoward Mortgage Team will help you get the best interest rates and lowest minimum down payments possible. This program combines 30-year, fixed-rate mortgages with financial assistance for your down payment or closing costs. Qualified applicants can receive up to 5% of the loan’s principal balance — depending on the mortgage type — in the form of a deferred, no-interest second mortgage. You don’t need to repay this second mortgage unless you sell or refinance the home within the first three years of ownership. Getting a 30-year, fixed-rate loan with less than 20% down typically requires monthly mortgage insurance, but with the Home Plus program, your premiums may be lower than usual. The program works with the government-sponsored enterprises Fannie Mae and Freddie Mac to offer mortgage insurance at a cost that’s lower than what you’ll see outside the Home Plus program.

There are several requirements necessary to be met before a first time buyer can qualify for a home loan. Our team of experienced brokers will determine if you meet the eligibility requirements, and will walk you through the application process step-by-step. KHoward will help you find the right loan program, the best terms, and provide the quickest turnaround approval time. Browse loan and assistance options for first-time home buyers below. The benefits of VA loans include no minimum down payment, so you can finance 100% of your home’s purchase price.

It’s forgiven monthly at a rate of 1/36 over the life of the loan. Perhaps best of all, Home Plus mortgages awarded through Fannie Mae and Freddie Mac come with lowered mortgage insurance premiums. That link takes you to a comprehensive 51-page guide to the program. Home Plus AZ may not be the only home buyer assistance program in your town, city, or county. So make sure you check out local down payment assistance programs in case one of those suits you better. But it does provide down payment assistance in the form of an interest-free, forgivable second mortgage with a three-year loan term.

There are some cases, such as when you have a lower credit score or when you’re a member of the military, where it makes sense to look at additional options. Pathway to Purchase Down Payment Assistance offers loans with down payment and closing cost assistance in targeted ZIP codes and cities. They do not require any down payment and carry a set interest rate. The interest rate changes based on market and prime rate fluctuations. On the other hand, Freddie Mac offers Home Possible® mortgages with down payments as low as 3%. The Home Possible® loan comes in 15- to 30-year fixed-rate and 5/5, 5/1, 7/1 and 10/1 adjustable-rate terms, along with the aforementioned cancellable private mortgage insurance.

No comments:

Post a Comment